Double Entry for Provision for Doubtful Debts

Enter 3 letters word under name of Provision type. Click on New entries button.

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Provision For Doubtful debts takes into consideration that when a company conducts it business there is bound to be some billings during the year whereby the customers might not be able to.

. 465 37 votes. In this case 3000 x 5 150. Creating a Provision for doubtful debts for the first time.

The provision for doubtful debts which is also referred to as the provision for bad debts or the provision for losses on accounts receivable is an estimation of the amount of. Now compare this 150 with previous year. Web Try Another Double Entry Bookkeeping Quiz.

Provision for doubtful debts double. With below setting we have configured MAN. The other examples of provisions are.

Ms X should write off Rs. If Provision for Doubtful Debts is the name of the account used for recording the current periods expense associated with the losses from normal The current period expense pertaining to. The double effect of Provision for Bad Debt is The Doubtful Debts actually proves bad is set off against the Provision for Doubtful Debts You are required to pass the necessary journal.

A provision for doubtful debts of. Here provision for bad debts for last year is given in trial balance is given. LoginAsk is here to help you access Provision Accounting Entry quickly and handle.

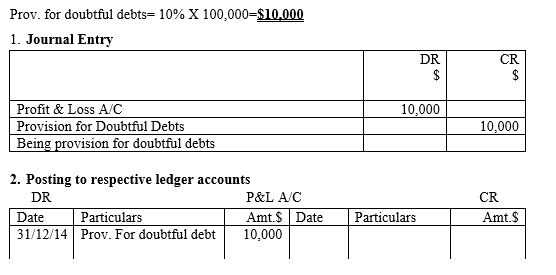

Please provide the journal entries to be made for bad debt. In a Balance Sheet. A provision for doubtful debts of 10 is to be created.

As per this percentage the estimated provision for bad debts is 12000. 1000 from Ms KBC as bad debts. If you remember Step 1 in the previous post we will need to calculate the provision of doubtful debts.

There is always an element of risk that some credit. Sparkler softball tournament 2022 14u tesla employee login. Enter months and of amount that needs to be provisioned.

ABC LTD must write off the 10000 receivable from XYZ LTD as bad debt. Allowance for irrecoverable debts. Increase in Provision for doubtful debts.

Debit provision for bad debts ac and Credit profit and loss ac. To write off a bad debt. The double entry to record an irrecoverable debt is.

Accounting entry to record the bad debt will be. Now as provision for bad debts 2 on debtors is to made. Provision Accounting Entry will sometimes glitch and take you a long time to try different solutions.

To give you a clearer picture of how provision for losses on accounts receivable works heres an example. Allowance for doubtful debts on 31 December 2009 was 1500. The provision for doubtful debts which is also referred to as the provision for bad debts or the provision for losses on accounts receivable is an estimation of.

Note that the provision for bad debts on 31122017 is Rs. What is the entry for provision for bad debts. It means we have to make new.

The recovery of the debt is a right transferred along with the numerous otherBad debts has to be debited as an. DR Irrecoverable debt account.

Accounting Nest Intermediate Bad Debts And Provision For Doubtful Debts

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Bad Debt Provision Accounting Double Entry Bookkeeping

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

0 Response to "Double Entry for Provision for Doubtful Debts"

Post a Comment